We will finally see the expansion of listing inventory, but where?

The ongoing expansion of listing inventory is a fairly recent trend. After years of limited housing supply that led to fierce competition, bidding wars, soaring prices and buyer frustration, listings are higher. The Federal Reserve pivoted three years ago toward raising interest rates at their steepest ascent in at least fifty years.

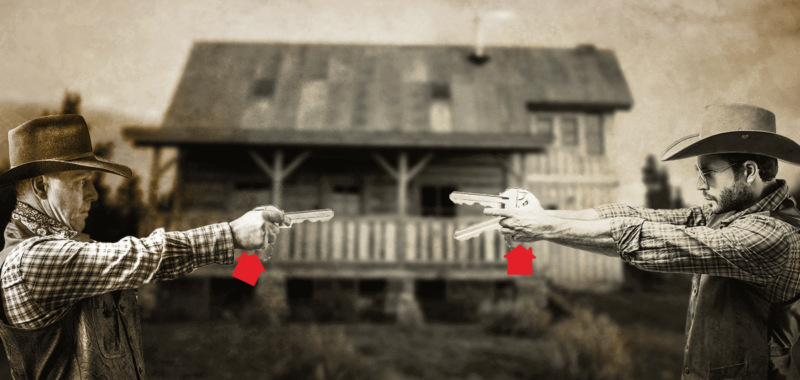

Before that, the Sun Belt regions, including Florida, Texas, Arizona and North Carolina saw rapid population growth, supported by remote work growth. The region’s affordable cost of living and favorable climate contributed to substantial inventory growth following the pandemic. But elevated mortgage rates have curtailed sales, leaving housing supply largely untouched. More supply already reduced the competitive pressure seen in previous situations years.

While house prices will keep rising, it won’t get too crazy

Housing prices are increasing slower than the sharp jumps we’ve seen previously. After the pandemic-driven housing boom, the market is beginning to cool down. Home values are increasing moderately and sustainably in many areas, unlike the double-digit annual increases that characterized the pandemic era.

Several factors contribute to this slowdown. First, higher mortgage rates have dampened buyer demand, as monthly payments for new buyers are becoming increasingly unaffordable for many. Second, inflationary pressures and concerns about a potential economic downturn have made both buyers and sellers more cautious. Although prices remain high compared to historical norms, the rate of increase aligns more closely with long-term trends, creating a more balanced market environment.

2025 won’t do us any favors on mortgage rates

Mortgage rates are vital in shaping the current housing market. During the pandemic, historically-low interest rates sparked a sales frenzy and consisting mostly of existing home sales. The Federal Reserve’s actions to combat inflation through rate hikes caused the 30-year mortgage rate to more than double, now hovering around 7%. Elevated mortgage rates slashed housing affordability, as potential buyers encounter higher borrowing costs and limited inventory kept prices high.

Potential sellers who secured lower mortgage rates during the pandemic may hesitate to list their homes, resulting in a tight supply of move-up properties. This mindset created a situation where homeowners feel “locked in” with their current properties, which limits turnover and contributes to less new housing listings. Unfortunately, 2025 will likely mirror this trend, as mortgage rates are unlikely to drop. Strong economic conditions don’t foster an environment for lower mortgage rates.

Good news: there will be a modest increase in home sales

Home sales saw modest monthly gains despite challenging mortgage rates. However, they remain below historical norms. This stems from several factors. On one hand, there is considerable demand from buyers willing to pay a premium for good homes in desirable locations. However, declining affordability, inflation and economic uncertainty are making buyers hesitant to make significant financial commitments.

Moreover, inventory still remains limited in some markets, as all real estate is local. Potential homebuyers waited three years for mortgage rates to drop, yet their lives continue to move forward. Last fall’s rise in sales shows a waning desire to stay inactive. The gradual influx of new listings provides buyers with more options, which were significantly lacking a few years ago.

Innovation in housing will continue in surprising ways

Although there are significant, disrupting housing initiatives on the horizon, innovation is already occurring.

Lending products are expanding to meet the needs of lower- to middle-income borrowers. These products may include more access to down payment programs and traditional forms of home loans, such as non-QM underwriting. Home values may not remain elevated in some regions of the country. As such, products like Home Value Lock will help homebuyers manage this uncertainty. Its policies will offer real estate agents and mortgage brokers a valuable tool for home purchase negotiations, letting clients know their investment is protected against short-term value declines.

These five trends show that the housing market is shifting from to a more balanced environment, with some areas offering more favorable conditions for buyers. Higher mortgage rates and a less-than-stable economy will challenge many prospective homebuyers.

It will be crucial for all participants to stay informed about changing trends and conditions. Buyers and sellers need to navigate the complexities of mortgage rates, inventory levels and pricing dynamics to make informed decisions that align with their financial goals.

Ultimately, while the housing market is not expected to return to the frenzied pace of the pandemic years, it remains a critical area of focus for both individuals and the broader economy.