Rental fleets were down 16.2% year-over-year in December 2024 at 92,386 vehicles compared to 110,198 vehicles sold in December 2023.

Total U.S. fleet vehicle sales eased down by 2.5% in 2024 as OEMs appear to be meeting the demand of fleet operations that have restored fleet sizes since the pandemic that constricted supply, according to Bobit/Automotive Fleet sales data released Jan. 6.

Rental and government fleet vehicles showed slight gains for 2024, which wasn’t enough to offset the larger decline in commercial fleet vehicles sold.

Rental fleet vehicles comprised almost half of all fleet vehicle sales in 2024.

Among all commercial, rental, and government sector fleets, total sales for the year reached 2,125,441 vehicles, compared to 2,179,751 vehicles in 2024 and 1,698,656 in 2022. That represents a 2.5% decrease over 2023 and a 20% decrease over 2022.

Broke down by fleet sector, 2023 sales figures show:

- Commercial sales totaled 814,391, down 8.3% from 888,123 in 2023.

- Rental fleet sales reached 1,036,830 up a slight 1.7% from 1,019,225 in 2023. Rental cars took 49% of the total fleet vehicle sales last year.

- Government sales came in at 274,220 vehicles, up 0.7% from 272,403 in 2023.

Fleet Sales End Year With a Double-Digit Dip

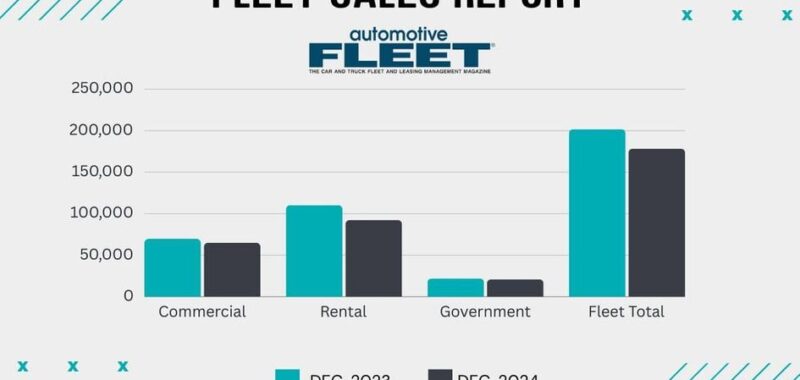

Among the three fleet sectors, December 2024 sales ended the year down 11.6%, at 178,395, compared to 201,808 in December 2023.

Monthly sales figures broken down by fleet sector include:

- Commercial fleet sales were 64,978 vehicles last month compared to 69,647 in December 2023, a decline of 6.7%.

- Rental fleets were down 16.2% year-over-year in December 2024 at 92,386 vehicles compared to 110,198 vehicles sold in December 2023.

- Government fleet sales last month were 21,031 vehicles, down 4.2% from 21,963 in December 2023. [Hyundai, Nissan, Subaru and Toyota did not report any monthly fleet sales].

For the full year, overall fleet sales declined against 2023, but the pace of fleet sales varied over the year, much like the broader market overall,” said Jeremy Robb, senior director of economic and industry insights for Cox Automotive, in a Jan. 6 email. “Commercial fleet customers may have fulfilled most of their pent-up demand last year in 2023 and pulled back as the prices of new vehicles remained high over the course of the year (and even rose over the fourth quarter). Rental customers showed more demand earlier in the year as they rebuilt their overall fleet from the pandemic before backing off in the second half of 2024.”

One factor contributing to the flatter fleet sales was the OEMs producing and selling more high-end luxury vehicles to consumers than before, Robb said, which are not the same types of vehicles sought by fleet operations.

Bobit Business Media (BBM), owner of Automotive Fleet, Vehicle Remarketing, Government Fleet, and Auto Rental News, compiles fleet sales numbers that reflect aggregate figures from the three major Detroit-based auto manufacturers and the Asian Big 6 automakers.